Health Insurance Rebates

TENS Machines commonly attract rebates from health insurance providers

Each provider has a different policy of course and this can change frequently. There are also different claiming processes from provider to provider.

We have provided the most recent rebate information on some of the more popular private health providers. Please inform us as part of your order so we can send you the appropriate receipt for claiming your rebate.

Do I need a doctor's referral?

Many health providers require a letter of support from your doctor so it is wise to have this in advance.

What if TENS isn’t mentioned in my health insurance policy?

Be aware that a TENS machine may also be referred to as a “Health Aid” or “Health Appliance” in your policy, so you may need to clarify this with your provider.

Claiming Your Elle TENS Machine with Medibank Private

If you have Medibank Private health insurance, you may be eligible to claim a portion of the cost of your Elle TENS machine. To claim, you will generally need to provide your receipt to Medibank along with any necessary documentation. We strongly recommend checking your specific policy details with Medibank directly before purchase to confirm your level of cover, claiming procedure, and any applicable waiting periods or annual limits.

Health Insurance Providers

The below list of providers and rebates were correct at time of publishing. Please ensure you check directly with your insurer for up-to-date rates, to verify your personal level of cover and any other mandatory requirements included.

Medibank Private

Advantage Plus, Premium Plus, Smart Plus and Healthy Plus Policies can receive 100% rebate (depending on unclaimed bonus points).

Teachers Union Health

Ultimate Choice – Easy Choice and Ancillary Cover – 85% rebate.

Australia Unity Health Limited

Active Extras – 70% back up to $400 combined limit.

GMHBA

Mid Extras – 100% back up to $100 annually, every 3 years. Mid Extras 65% – 65% back up to $100 annually, every 3 years. Top 70 – 7% to 100% back depending on item, up to $500.

Health Insurance Fund of Australia (HIF)

Advanced Extras – 75% back up to $500. Top Extras – 75% back up to $800.

Latrobe Health Services

Core Complete Extras – 70% back up to $200 per person every 3 years. Premier Family Extras – 65% back up to $500 every 2 years. Premier Singles & Couples – 65% back up to %500 every 2 years. Premier Extras – 90% back up to $250 per person every 3 years.

Mildura Health Fund

5 Star Extras – $20 every 3 years. Mid Extras – $150 every 3 years. Base Extras – $125 every 3 years.

Peoplecare Health Insurance

Premium Extras – 80% back up to $700 every 3 years. High Extras – 70% back up to $500 every 3 years.

*If you are a Medibank customer, Medibank have advised your claim will need to be completed via shopfront or by mail.

* If you are a Defence Health customer, please claim through the mobile app, email or via post. The portal cannot be used for this type of claim and no provider number is required.

People are often surprised to hear that rebates are available on TENS through Private Health Insurance Cover.

There are a few caveats around that though – all Private Health Insurance companies are different, some have unique requirements when claiming and also individuals tend to have different levels of cover depending on their personal circumstances. Please check in with your insurer so you understand their requirements for a smooth claims process.

What will my rebate be?

Firstly, please check with your insurer to avoid disappointment.

To give you an idea of rebates here are some examples which were correct at time of publishing, again please check directly with your insurer for up to date rates and verify your level of cover and their requirements such as a doctors letter etc.

- Australian Country Health - Select Ancillary $150

- BUPA – up to 70% top cover * please refer to BUPA specific information

- Defence Health - Top Extras $250 every 3 years

- HCF - Multi Cover Extras $170

- MBF - Extra Cover $130

- Medibank Private - Advantage Plus / Premium Plus / Smart Plus / Healthy Plus 100% depending on unclaimed bonus points

- NIB - Quality Extras / Gold Cover $195

- NSW Teachers - Top Extras $160

- NRMA - Top Cover Extras $200

- Police Health Fund - Extras Cover 80% or $150

- QLD Teachers Union Health - Ultimate Choice / Easy Choice / Ancillary 85%

- QLD Country Health - Private Hospital 85%

- St Lukes Tasmania - Select Plus Extra 80% or $200

- West Fund - Platinum $200

- West Fund - Silver Extra $150

So how do you get the right information?

The best place to find out what rebate you might be entitled to is through your own insurer. Be aware that the person answering the phone may not know what a TENS is but they will be familiar with Health Aids or Appliances which is sometimes what TENS is categorised as.

What other supporting information might my insurer ask for?

When claiming your rebate, your insurer may ask for a letter of support from your doctor,

If you are a BUPA customer, they will require a provider number from the retailer. We are a BUPA Recognised provider and can provide a compliant receipt for your purchase. Our BUPA provider number is: EP00566*

Frequently Asked Questions

Can I claim a TENS machine through my private health insurance?

Can I claim a TENS machine through my private health insurance?

Many private health funds in Australia offer rebates for TENS machines, often under Health Aids, Health Appliances, or Medical Equipment categories. Each fund has its own rules, so it’s important to check your specific level of cover to confirm eligibility before purchasing.

Do I need a doctor’s referral or letter of support to make a claim?

Do I need a doctor’s referral or letter of support to make a claim?

Some insurers require a doctor’s letter to support your claim, while others do not. Because requirements vary, it’s a good idea to have a referral ready, especially if your insurer specifies that the item must be medically recommended.

What information do I need from Elle TENS to lodge my claim?

What information do I need from Elle TENS to lodge my claim?

We provide compliant invoices which include all the details that insurers require such as ABN, itemised information, your details and ours etc

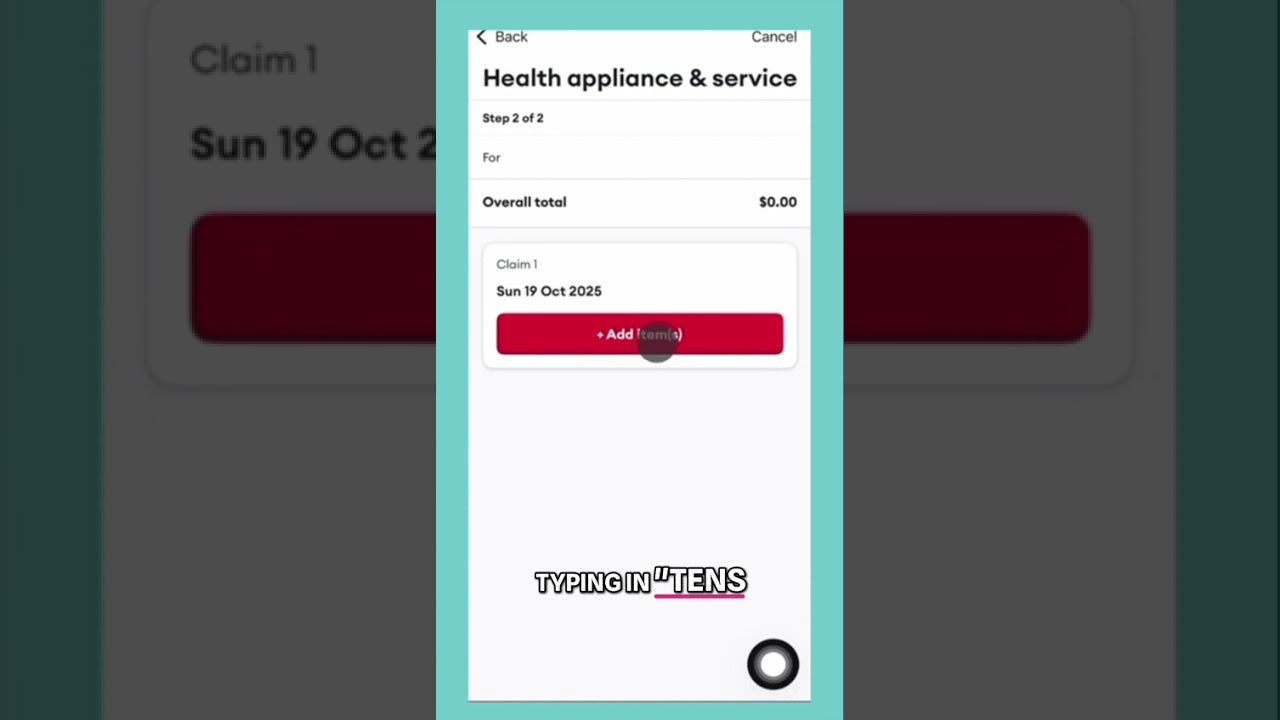

Some funds, like BUPA, also request a provider number, which we supply. Others such as Medibank Private are a manual claim - check out our video on how to claim with Medibank here.

My health fund doesn’t mention TENS - can I still claim?

My health fund doesn’t mention TENS - can I still claim?

Yes - TENS machines are often listed under category terms such as Health Aid, Health Appliance, Medical Device, or Therapeutic Equipment. If TENS isn’t listed by name, check with your insurer using these broader categories.

How much will my rebate be?

How much will my rebate be?

Rebate amounts vary widely between funds and depend on your extras cover, limits, and waiting periods. Some policies offer fixed-dollar rebates, while others cover a percentage of the purchase price. Always check directly with your insurer for the most accurate and up-to-date information.

Can I claim a rebate on any TENS machine purchased from Elle TENS?

Can I claim a rebate on any TENS machine purchased from Elle TENS?

Most insurers accept claims for approved, therapeutic-grade TENS devices, and all Elle TENS machines fall within this category. However, whether the device is eligible for rebate depends entirely on your health fund's policy.

How do I make sure my claim is processed smoothly?

How do I make sure my claim is processed smoothly?

Before purchasing, check your insurer’s requirements and clarify whether you need a referral. After purchase, submit your Elle TENS invoice and any supporting documents your fund requests. If your insurer needs retailer details (such as BUPA’s provider number), we have this information available on our invoices. Where no provider number is listed on our invoices, this will mean you will need to complete a manual process for your claim.